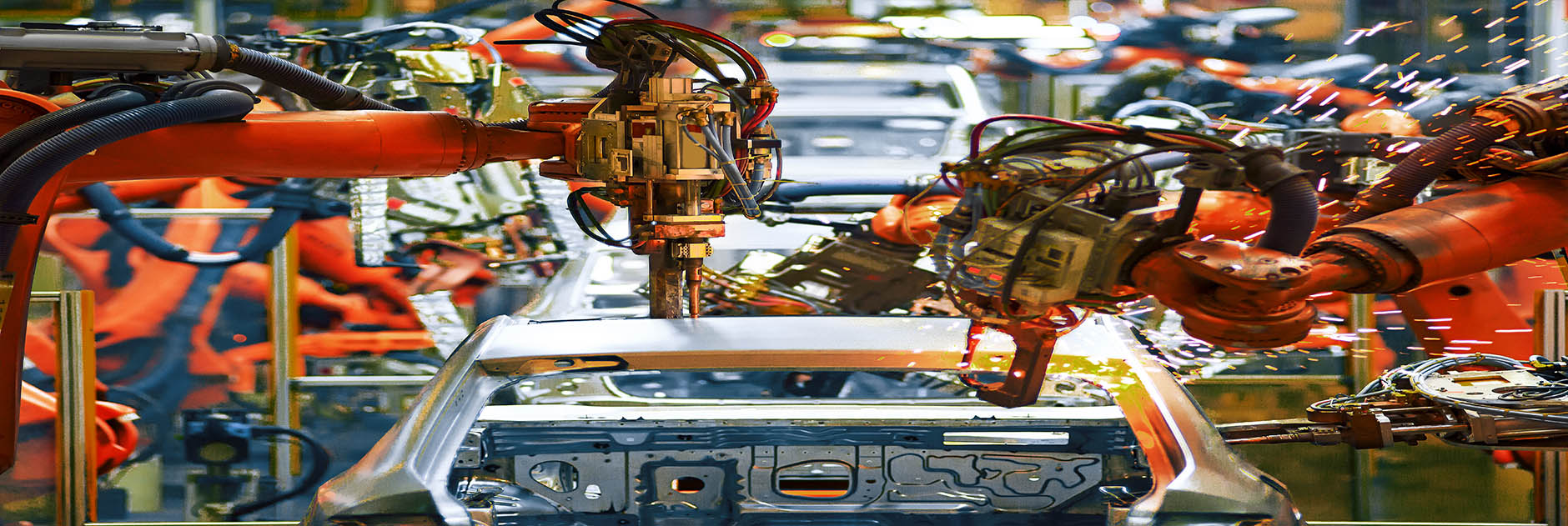

With the increasing global instability, and rising wages from countries like China and India, there has been a resurgence of metal manufacturing in the United States, as more manufacturers shift back. With the increased in competition and complexity in the metal manufacturing industry, there is a need for these companies to constantly improve and update their equipments to stay competitive. To do so, metal manufacturing firms will require a significant amount of capital. With CMS Funding, our affordable and fast business loans can help you get the financing solutions you need to stay ahead in the competition.

About Metal Manufacturing Businesses

Metal manufacturing has broad applications across a great variety of industries such as the automotive industry and the construction industry. They are businesses that involve a mix of raw materials, advanced machinery and many different skill sets that come together to convert these raw materials into their final products. The two winning factors that companies need to remain competitive in the industry are speed and cost. To achieve these two factors, metal manufacturers need to consistently train its workers and update their equipment. Yet, these activities are capital intensive and small businesses in this sector often struggle to secure the funding needed.

It is important that metal manufacturers have seamless access to funding options to ensure that their equipment and skill sets are constantly kept up to date. By doing this, they will be able to retain their clients and keep their net profits consistent.

Benefits of Our Working Capital Loans

How can metal manufacturing companies benefit from our small business loans?

- Working Capital Loans – Secure cash on hand to help with operational expenses such as payroll and raw materials.

- Flexible Repayment Terms – Metal manufacturing firms can better manage their cash flows.

- Equipment Loans – CMS Funding will provide the capital loans needed for you to update your equipments and grow your business.

- High Approval Rating – CMS Funding will be a reliable partner for all of your business financing needs.

What CMS Funding Offers for Metal Manufacturing Businesses

Below is a list of our key small business loan features:

- Funding up to $500,000 for working capital loans or $2,000,000 for equipment leases

- Funding available within 24 to 48 hours

- Terms ranging from 6 to 24 months

- Non-obligatory application after consultation

- High approval rate

- No collateral required (unsecured loan)

- Low interest rates

- Simple one-page application

- Quick and easy approval process

- Automatic payments

- Excellent customer service

- … and more!

Get the Funding You Need to Grow Your Business Today

CMS Funding is your best solution for a reliable, fast and convenient way to get a loan for your company. Applications are typically approved within 24 hours, with competitive interest rates. We have access to a large variety of business lending products, and is accredited by the NEFA (National Equipmment Finance Association). We have also received an A+ rating from the BBB (Better Business Bureau), further proving our credibility.

If you have any questions about our small business loans for metal manufacturing businesses, do not hesitate to fill out our online working capital application form or call us at (855) 793-8637 to learn more.